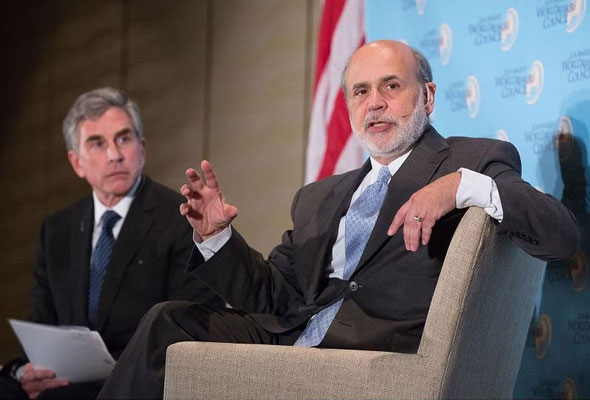

Ben Bernanke with Moderator Russell Goldsmith, Chairman & CEO of City National Bank

Ben Bernanke with Moderator Russell Goldsmith, Chairman & CEO of City National BankBen Bernanke said he's "moderately optimistic" about the future of the US economy which he described as being in "good shape" with steady growth for the last 6-7 years. He said developing economies like Brazil, Russia, Turkey and South Africa have the "most volatility and risk" and that it is "appropriate to watch very closely what's happening in the emerging markets - in China and everywhere else because it does affect us." Speaking to the Los Angeles World Affairs Council at a dinner on Monday, March 7th, the former Chairman of the Federal Reserve also talked about longer term challenges in the US including infrastructure investment and closing the income inequality gap.

Bernanke said "we have made a lot of progress" with the economy, and consumers and households are better off in terms of jobs and wages. He said there is less debt, the housing market is up, gas prices are down and mortgages are down too. "Everybody is really envious of our economy." Europe, Japan and China are not doing nearly as well. However he pointed out that in a globalized economy the difficulties of other nations are "a bit of a restraint, a headwind for our economy."

"Looking forward I think we're sort of in a tug of war between the dynamic forces that are driving us forward - from housing, consumers, governments, and so on - versus the international factors which have generally been a bit of a headwind," said Bernanke in a discussion moderated by Russell Goldsmith, Chairman and CEO of City National Bank. Bernanke said the US is "extremely well-placed" in overall competitiveness because much of the future economic growth in the world will come from technology, and "surveys show that of the top research universities in the world, 19 out of 25 are here in the US."

Bernanke said there are some longer term trends we should pay attention to including increased income inequality, because despite overall economic growth, it has not been shared equally. "From the point of view of someone from the lower third of the income distribution, from their perspective, it looks like thing aren't getting better, they have been stagnating... Not just for the last three years, but for the last three decades." Bernanke also said our "national infrastructure is not in great shape - our roads and our bridges and our schools and our airports.... I would think from the perspective of making our economy more productive, there should be some smart infrastructure investment."

On what it was like behind-the-scenes during the 2008 financial crisis, "Everytime I saw a bumper sticker 'where's my bail out?' it was painful because everyone thinks the banks were saved and everyone else got thrown to the wolves." Bernanke said the reason the Fed intervened was "to prevent the financial crisis from collapsing - because we knew from theory, from history, from experience, we knew that if the financial system collapsed, the whole economy would come tumbling down. People were pretty skeptical about that." He wrote about this in detail in his new book The Courage to Act: A Memoir of a Crisis and Its Aftermath and added that the implications during the crisis were for everybody - everybody who had a job, everybody who had a business. "Not everybody understood that we were trying to save the system and not just trying to save our buddies on Wall Street. I was an academic, I don't have any buddies on Wall Street."

Bernanke said that it was understandable why people weren't happy. "A lot of the anger comes from misunderstanding and from the opportunism from some politicians who distort the record." He compared 2008 to the 30s after the 1929 crash when there were marches on Washington and a lot of political blowback. "We did what we could to protect the economy, the world economy." Bernanke talked about going to Congress with Hank Paulson and saying that "if we didn't do something, we're not going to have an economy on Monday. That was a little bit of an exaggeration, but not that much."

And when they did do something, they were criticized by politicians on both sides - particularly over the Troubled Assets Relief Program (TARP). Bernanke called one US senator to ask what his constituents were saying and was told, "50/50 - 50% no and 50% hell no." And yet Bernanke said the record shows that "TARP saved the financial system, saved the automobile industry, it helped millions of home owners, it got back every penny with a profit. It's one of the most successful government programs, and still one of the most unpopular government programs in history." He said they understood at the time, "as distasteful as it was in many cases, it was not really an option to let the financial system implode. It almost did anyway."

When asked why nobody was jailed for their roles in the financial crisis, Bernanke said he felt the Department of Justice strategy to indict institutions and not individuals was misguided. "The whole bank would be indicted and would pay a fine, but the individuals that were involved didn't necessarily pay any penalty."

Bernanke also stressed the importance of the global economy. "As the Fed thinks about the US economy, we need to think about our trade with other countries." He said our financial markets are affected by what's happening globally. "For example, even though our overall economy is doing pretty well, our manufacturing sector is not doing that well and the reason is because manufacturers, much more so than services, sell their goods abroad to other countries," said Bernanke. "When you think about what the US economy is going to do, you can't ignore the rest of the world."

Bernanke said China is "complicated because they are in the middle of a very difficult transition." He said China's economy had been growing quickly based on heavy manufacturing and exports, but that model has "kind of run its course." The Chinese leadership is also coping with a population of 1.4 billion people transitioning from living on a dollar a day to approaching middle class. Other emerging markets like Brazil, Russia, South Africa and Turkey are suffering from a slowing China because they can't export as much to the country. Emerging markets are also struggling with financial instability, the strong dollar (because they borrowed money in dollars), and oil prices are also down. "Years ago we wouldn't have cared," said Bernanke on emerging markets. But now because everything is so tied together economically "it will affect us either directly or indirectly."